Credit Software

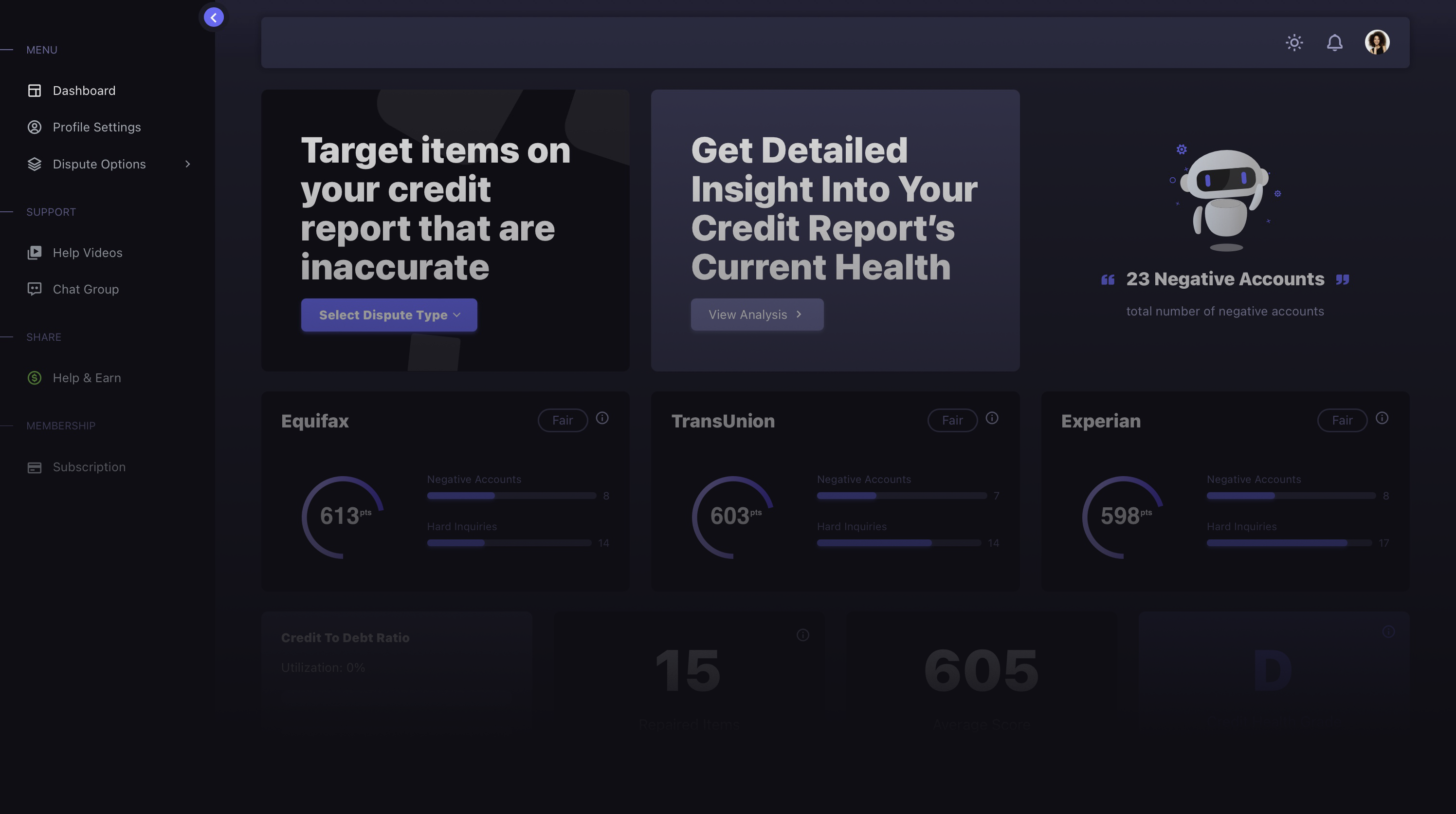

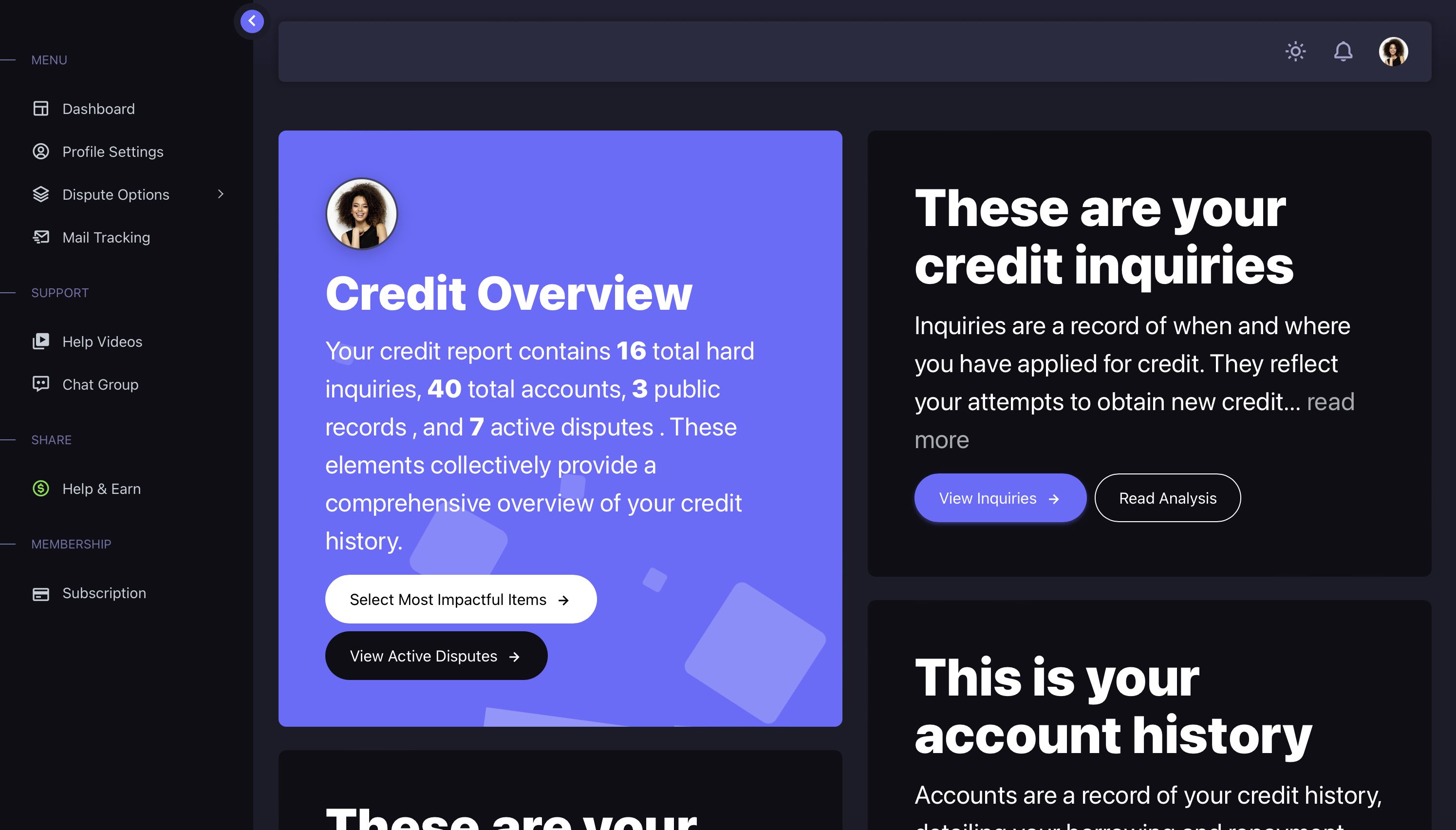

dispute negative items on your credit report or let our credit experts do it for you.

Smart Credit Monitoring

We analyze and keep track of your credit report for you.

-

Dispute Inquiries

-

Dispute Accounts

-

Dispute Public Records

-

Dispute with Creditors

-

Freeze Credit Reports

Simple steps to a

better credit score.

We made it easy to dispute negative items.

Credit Repair & Artificial Intelligence

Our AI analyzes your credit report and can provide insightful information for optimal decision-making. Give it a try, hit the switch below!

Any questions?

Check out the FAQs

Our software is for anyone that wants to improve their credit score or monitor their credit profile. It doesn't matter if you have a 300 or 800 credit score, we can help you improve your credit score by potentially removing negative items from your credit report or spotting potentials areas of improvement.

It depends on your credit report and how many negative items you have. Some users have seen results in as little as 30-45 days, which we never guarantee.

Yes, you can cancel your subscription at any time without contacting us. Simply login to your account and find the subscription page, then click the cancel button located within current plan.

Yes, your data is safe. We use the latest encryption technology to ensure your data is safe and secure. We do not sell or share your data to any third parties.

Credit Scores Matter

A higher credit score can help you get approved for a loan, even if you have low income. Having a lower interest rate can save you thousands of dollars over the life of your loans.

Many Americans have less than stellar credit scores, and it's costing them thousands of dollars every year. Let us help you get your credit score back on track with our free credit repair software.

See how your credit score is calculated by the 3 major credit bureaus.

35% of your score is based on your payment history. This is the most important factor in your credit score. If you have missed payments, your score will be impacted the most by this metric.

30% of your score is based on your credit utilization. This is the amount of credit you are using compared to the amount of credit you have available. If you are using a lot of credit, your score will be lower. Try to keep your credit utilization below 30%.

15% of your score is based on the length of your credit history. This is the amount of time you have had credit. If you have had credit for a long time, your score will be higher.

10% of your score is based on the types of credit you have. This is the different types of credit you have. If you have a variety of credit for example - credit cards, auto loans, and mortgages, your score will be higher.

10% of your score is based on new credit. This is the credit that you applied. Although a necessity, inquiries stay on your credit report for 2 years, so try to avoid applying for new credit if possible.

Please Wait

Please Wait